About

Oxford Algorithms creates and applies proprietary Machine Learning software solutions to drive smart investment decisions that result in market neutral, consistent and compelling returns.

Our team includes experienced technologists, and entrepreneurs with experience in AI software development, in addition to mathematical and financial experts with quant trading experience at some of the world’s leading banks.

Meet the Senior Team

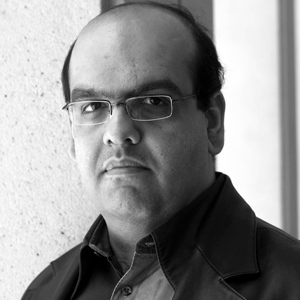

Dr Mohsen Zadeh-KoochakCIO, Head of Technology

Dr Mohsen Zadeh-KoochakCIO, Head of Technology Shirin DehghanCEO

Shirin DehghanCEO Mobin Zadeh KochakDirector of Software Development

Mobin Zadeh KochakDirector of Software Development Shahram NikbakhtianDirector of Quant/ML trading

Shahram NikbakhtianDirector of Quant/ML trading Patrick DowlingConsultant CFO

Patrick DowlingConsultant CFO Professor Rama ContScientific Advisor

Professor Rama ContScientific Advisor Martin S. HaugeChairman

Martin S. HaugeChairman Dr Simon GalbraithStrategic Advisor

Dr Simon GalbraithStrategic Advisor James OrbellAdvisor

James OrbellAdvisor

Our story

Our founding story is unconventional in the hedge fund world and hinges around the passions of two Oxfordshire entrepreneurs. Dr Mohsen Zadeh-Koochak, and Shirin Dehghan. Their journey commenced during their time at the University of Southampton, where Mohsen was pursuing a Ph.D. in Signal and Image Processing, and Shirin was undertaking her undergraduate degree in Electronics.

Their paths converged as they discovered a mutual fervour for technology and business. This shared enthusiasm led to the establishment of their first company, Arieso, in 2002, where they successfully developed and deployed world’s first big data enterprise grade software that was responsible for managing multi-billion $$ telecoms infrastructure assets around the world. Their experience of delivering industry grade software whilst applying sophisticated mathematics and machine learning techniques to detect the smallest of signals amongst the ocean of noise has been directly transferable to the financial markets.

Arieso swiftly evolved into a thriving tech enterprise, ultimately culminating in its sale for $85 million in 2013, delivering substantial returns of 5 to 10 times to their investors.

Rather than resting on the laurels of their initial success, Mohsen and Shirin’s passion persisted. Their entrepreneurial spirit and shared commitment to technology and innovation fuelled the inception of Oxford Algorithms, marking the continuation of their journey into the dynamic world of finance and investment. This unique founding story underscores the intersection of technology, business acumen, and a relentless pursuit of shared passions that define the ethos of our hedge fund.

Mohsen has spent many years investigating the application of AI; specifically as applied to solving complex multifaceted problems. He was CTO and CSO at Arieso where complex mathematical modelling and the application of AI was used to manage self-learning mobile networks. Collecting billions of data gathered in real-time from subscriber handsets, behaviours were identified using AI, and the network was conditioned to best serve the customer base as a whole maximizing the quality of service for all. Mohsen’s love for predicting the unpredictable started with his research in this field whilst completing his PhD and led to the publication of a book detailing successful card counting strategies for blackjack – so successful were his methods that they ultimately resulted in him being barred from all UK casinos. More recently though, Mohsen turned and tuned his algorithms towards successfully predicting the outcome of matches in over 30 football leagues.

Mohsen set out to find out if the algorithms he had developed for predicting mobile networks and sporting outcomes could be used to forecast the markets. After three years of hard work and development, it transpired that not only could the algorithms predict market movements, but they were forecasting what looked like industry-leading returns. When Shirin learned how unique and successful the algorithms were she realised this cottage industry idea could be transformed into a commercial mansion, and she set about building a team capable of bringing it to market.

The team at Oxford Algorithms experienced significant expansion with the addition of key individuals who brought diverse and invaluable expertise. In 2020, Professor Rama Cont joined, contributing academic rigor and the latest research in financial mathematics. His wealth of knowledge enhanced the team’s theoretical foundation.

Following Professor Cont, James Orbell became a valuable member. With previous experience as the Head of Aberdeen FoF, overseeing a multi-billion-dollar fund that invested in numerous quant and discretionary hedge funds, James brought extensive industry insight and strategic acumen to the team. Mobin joined the team as a key and experienced full-stack developer. His role was pivotal in transforming the visualization capability and optimization of the data/server management aspects of the company. Leveraging his expertise, Mobin played a crucial role in enhancing the technological infrastructure of Oxford Algorithms, contributing to its efficiency and adaptability in the rapidly evolving field of financial technology.

Furthermore, Shirin strategically enlisted Shahram, a seasoned professional with extensive commercial experience in developing quant strategies. Shahram’s noteworthy background, including his prior role as VP of Quant Trading at a prominent bank, underscored his deep expertise in the intricacies of quantitative finance. The addition of Shahram significantly strengthened Oxford Algorithms by bringing aboard a key player with a wealth of knowledge and experience, particularly crucial for navigating the complexities of the financial technology landscape.

On the regulatory and commercial side, Shirin was strategic in building a robust and experienced team. She brought on board Patrick Dowling as a consultant CFO, leveraging their close collaboration developed over many years at Opensignal. Patrick’s financial expertise and shared history with Shirin added a valuable layer of experience to the team, particularly in managing the fund’s financial aspects and contributing to the strategic vision of the company.

Our culture

We are entrepreneurs, scientists, software engineers and mathematicians who are united by a shared passion for innovation and growth.

We foster a supportive and inclusive environment where every individual is valued and respected.

We aim to ensure everyone is treated fairly and with respect, providing a collaborative and challenging working environment in which equal opportunities are provided to all and achievement is fairly rewarded regardless of gender, race, religion, sexuality, or social background.

We want everyone to share in the success of the company both in the short and long term. We operate a transparent environment, where we provide the underlying information used to decide on employee salary levels and bonuses.

Our values

At the heart of everything we do are a set of core values. These values define who we are and how we engage and interact, not only with our clients and each other, but also with our business partners, the local community, the environment, and society at large.

Client Focused – We strive to achieve extraordinary outcomes for our clients and make sure they are fully supported and delighted with us even when things are not going well.

Respect – At Oxford Algorithms respect for each other and our clients is a non-negotiable value that we all take very seriously. We are open and welcoming of new ideas and differing points of view, and always welcome constructive feedback.

Fairness – It is essential that people are treated fairly and feel rewarded for their contribution and length of service with the company.

Integrity – Being honest with ourselves and our clients is the number one rule of any business if it is to build an impeccable reputation, where employees are proud to be part of and clients are delighted to be doing business with.